Overview of Interest Types

Interest represents the cost of borrowing money or the return on investment from investments and savings.

Understanding the difference between basic and compound interest is essential for anyone making financial choices.

This applies whether they are assessing loan options or saving for future goals.

The difference between these two types of interest influences how money grows over time and the overall borrowing costs.

Understanding Simple Interest

Simple interest is calculated on the initial principal amount for the duration of the loan or investment.

This means that because the interest is not compounded, it remains constant over time.

For instance, if a person saves $1,000 at a 5% annual interest rate with simple interest,

the interest earned annually would be $50, and after three years, the total interest would be $150.

Simple interest is commonly used in savings plans or short-term loans where the calculation is straightforward.

Understanding Compound Interest

Compound interest, on the other hand, is calculated using both the original principal and the interest earned over time.

The investment can grow exponentially due to the compounding effect, setting it apart from simple interest.

For example, $50 would be the income earned in the first year if the same $1,000 was invested at a 5% annual interest rate, compounded yearly.

However, in the second year, the interest would be calculated on $1,050, generating $52.50 in interest.

This difference becomes more pronounced with longer investment periods, as compound interest significantly increases profits.

Understanding Interest Types Matters

Comprehending these principles forms the foundation for making sound financial decisions.

Effective financial planning requires understanding how each type of interest affects the total amount saved or owed.

This applies whether someone is preparing for retirement or considering taking out a loan.

What Is Simple Interest?

Simple interest is the interest calculated on the principal amount of a loan or deposit and is a fundamental concept in finance.

Simple interest depends only on the initial amount borrowed or invested, unlike compound interest, which earns interest on both the principal and the accumulated interest.

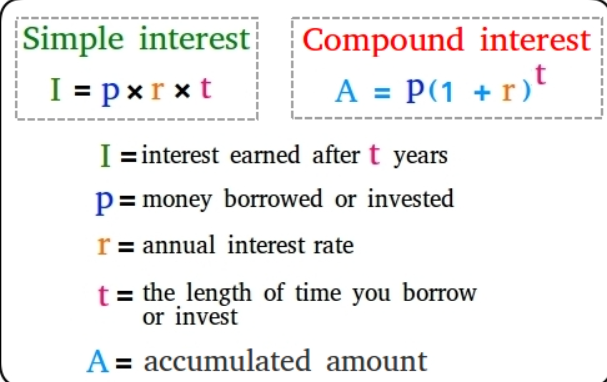

The simple interest formula is I = PRT, where P is the principal amount, R is the annual interest rate,

T is the time in years, and I is the interest earned.

Real-World Applications of Simple Interest

Simple interest is frequently used in various financial scenarios.

For example, it is commonly applied in personal loans, short-term loans, and certain types of savings accounts.

When a borrower takes out a short-term loan from a financial institution, the simple interest formula is often used.

This helps borrowers better understand their repayment commitments. Additionally, simple interest may be used in some savings accounts to offer a steady return on investment.

Limitations of Simple Interest

While simple interest has practical uses, its limitations must be considered.

One key disadvantage is that it often yields lower returns over time compared to compound interest, especially in long-term investments.

For short-term borrowing or investing, simple interest may be advantageous, but for longer periods, it may not be as beneficial for those looking to maximise capital growth.

Thus, it is crucial to understand the implications of using simple interest to make informed financial decisions.

What Is Compound Interest?

Compound interest is a key financial concept that involves earning interest on both the principal amount and the interest that has already accumulated.

This differentiates compound interest from simple interest, which is based only on the principal and does not account for the interest accrued over time.

Compound interest can lead to significantly higher returns on investments, particularly when allowed to grow over extended periods.

Formula for Calculating Compound Interest

The formula for compound interest is A = P(1 + r/n)^(nt), where A is the total amount accumulated after n years, including interest.

Here, n represents the number of times interest is compounded annually, t is the time in years, P is the principal amount, and r is the annual interest rate (in decimal form).

This formula illustrates how regular application of interest can significantly affect the total accumulated amount.

Impact of Compounding Periods

Consider a $1,000 investment compounded annually over ten years at a 5% annual interest rate.

Using the formula, the total sum would be around $1,628.89.

If the same investment were compounded monthly, it would grow to around $1,647.01.

This highlights the effectiveness of compounding periods: the more frequently interest is applied, the higher the returns, as monthly compounding yields better results than annual compounding.

Key Differences Between Simple and Compound Interest

It is essential to understand the differences between simple and compound interest when evaluating financial options.

Simple interest is calculated based only on the principal amount of the loan or investment.

The formula for simple interest is: Interest = Principal × Rate × Time

This means the interest rate remains the same throughout the investment period, making it suitable for short-term loans and investments.

It allows people to precisely forecast the amount of interest they will earn or owe.

How Compound Interest Differs

Compound interest, in contrast, accounts for both the principal and the interest that accumulates over time.

The formula for compound interest is A = P(1 + r/n)^(nt), where A represents the total accumulated amount after n years, including interest.

By calculating interest on the money that has already been generated, this method allows growth to compound over time.

The ‘interest on interest’ concept can significantly increase overall returns, particularly with long-term investments.

Growth Potential of Simple vs. Compound Interest

When comparing the growth potential of simple and compound interest, it is clear that compound interest tends to perform better, especially over long periods.

For example, an investment earning compound interest may double or even triple over decades, depending on the rate and frequency of compounding.

In contrast, simple interest will provide a linear return, which is less profitable for long-term investments.

Choosing Between Simple and Compound Interest

Your financial objectives will largely influence whether you choose simple or compound interest.

For short-term loans or standard savings accounts, simple interest may be advantageous.

However, compound interest is often the better choice for long-term growth investments.

It is essential to understand the subtle differences between these two types of interest in order to make well-informed financial decisions that align with your unique financial goals.