Recognising the Distinction Between Working Capital and Fixed Capital

Overview of Capital Concepts

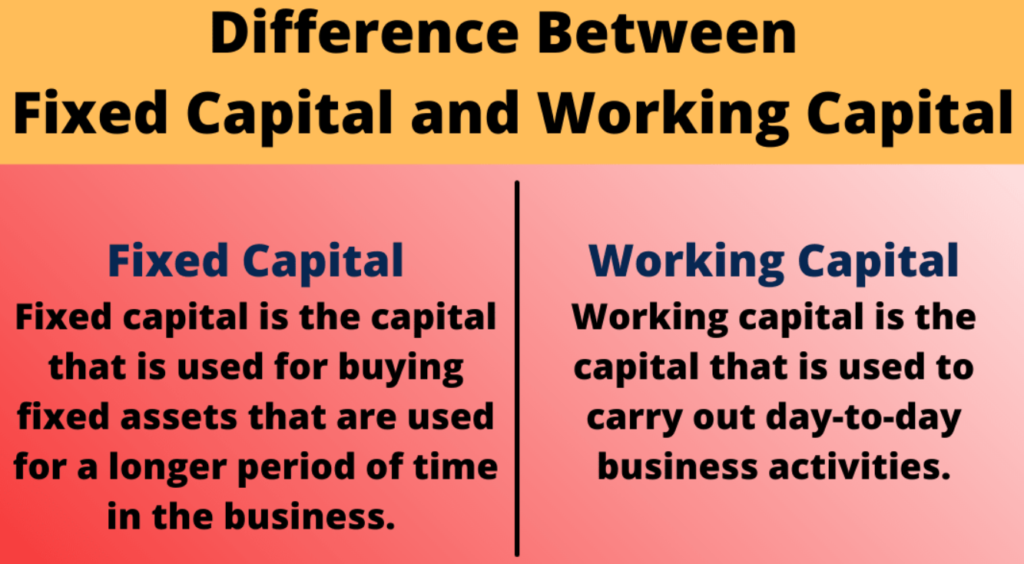

Capital is a key concept in business, describing the monetary resources that an organisation uses to finance its operations and enable expansion. A company’s overall financial stability and health are greatly influenced by its capital. Generally, capital falls into two main categories: working capital and fixed capital. By understanding these differences, businesses can better manage their financial resources and strategic planning.

Understanding Fixed Capital and Its Importance

Fixed capital refers to long-term investments a company makes to purchase tangible assets like buildings, equipment, or land. These assets play a crucial role in a company’s long-term operating and production capacities, rather than being easily converted into cash. In contrast, working capital includes cash, inventories, and accounts receivable. It refers to the short-term financial resources required for day-to-day operations. A company that manages its working capital well can meet its immediate responsibilities and maintain effective operating procedures.

Managing Both Working and Fixed Capital for Business Success

A company’s success depends on efficiently managing both working and fixed capital. These factors have a direct impact on profitability, liquidity, and operational effectiveness. By striking the right balance between these two forms of capital, businesses can ensure production continuity while keeping enough cash on hand to handle daily costs. To maximise financial success, capital management methods should take into account the dynamics of each sector and the specific conditions of each company.

The Importance of Capital Knowledge for Long-Term Business Sustainability

In conclusion, knowing the fundamentals of capital in a business context prepares one to recognise the important distinctions between working and fixed capital. Any company hoping to achieve long-term sustainability and growth in a highly competitive market must understand this information.

How to Define Fixed Capital

Understanding Fixed Capital and Its Role in Business Operations

Fixed capital refers to a company’s long-term investments in purchasing and maintaining physical assets required for its daily operations. These resources, essential to the creation of products and services, typically consist of buildings, machinery, land, and equipment. Fixed capital is distinct from working capital, as it contributes to the productivity and profitability of the business over a substantial period, whereas working capital focuses on short-term financial resources and daily operations.

The Features and Depreciation of Fixed Capital Assets

Understanding the features of fixed capital is crucial for appreciating its importance in company finance. Fixed capital investments differ from current assets in that they often involve significant upfront costs. These assets have enduring value, as once purchased, they can sustain production for several years. However, when fixed capital assets age and wear out, they often experience depreciation, which lowers their book value and affects the company’s balance sheet. This depreciation must be included in financial statements to provide a more realistic picture of the company’s net value.

The Importance of Fixed Capital in Driving Operational Efficiency

Fixed capital is the foundation of a company’s productive potential, and its importance cannot be overstated. By investing in fixed capital, a company can enhance operational efficiency, increase production, and ultimately boost revenue. For example, a manufacturing business may reduce labour costs and increase production rates by investing in advanced machinery. A strong fixed capital base supports ongoing operations and helps the business develop for the future. By managing its fixed capital assets carefully, a company can maintain its competitiveness in a constantly evolving market, reaffirming its commitment to efficiency and innovation.

Specifying Working Capital

What is Working Capital and Why is it Important?

Working capital is a crucial financial indicator of a business’s operational effectiveness and immediate financial stability. It is defined as the difference between current assets and current liabilities. Current assets include cash, accounts receivable, and inventory. Current liabilities include accounts payable, short-term loans, and other debts due within a year. Understanding working capital helps to assess how well a company can use its most liquid assets to pay its short-term financial obligations.

Why Working Capital is Essential for Day-to-Day Operations

The significance of working capital cannot be overestimated, as it is vital for day-to-day operations. A business with sufficient working capital can sustain production levels, pay its staff, and meet other urgent obligations without facing financial difficulties. Working capital is also a crucial measure of liquidity. A company with ample working capital can quickly convert assets into cash to pay its debts.

Working Capital Formula and Its Implications for Business Health

The formula for working capital is: Working Capital = Current Assets – Current Liabilities. A positive working capital allows a company to finance its operations and make investments for growth. Conversely, negative working capital may indicate financial difficulties or trouble continuing operations. This situation can lead to cash flow problems, which may threaten the company’s long-term sustainability.

Effective Strategies for Managing Working Capital

Effective working capital management involves strategies such as extending accounts payable without damaging supplier relationships, optimising inventory levels, and streamlining accounts receivable processes. By improving the management of these elements, businesses can significantly enhance their liquidity. Ultimately, a company’s ability to understand and manage working capital is critical to surviving and thriving in today’s competitive business world.

Important Distinctions and Relationships Between Working and Fixed Capital

Key Differences Between Working and Fixed Capital

In a company’s financial structure, working capital and fixed capital play different but complementary roles. Fixed capital refers to long-term investments in assets like real estate, machinery, and equipment required for producing products and services. These assets are typically used across multiple financial periods and are difficult to convert into cash. The main goal of fixed capital is to provide the infrastructure necessary for supporting ongoing operations and gradually increasing production capacity. Working capital, on the other hand, refers to a company’s short-term liquidity, calculated by subtracting current assets from current liabilities. It is crucial for managing daily operations and ensuring the business meets its short-term debts, such as wages, inventory purchases, and other costs.

Flexibility and Mobility of Working and Fixed Capital

One of the main distinctions between working and fixed capital lies in their characteristics and mobility. While working capital is more flexible and can fluctuate rapidly in response to a company’s operational needs, fixed capital tends to be more rigid, requiring significant upfront investment. An efficient working capital management plan focuses on optimising inventory levels, receivables, and payables. It also aims to minimise expenses while maintaining adequate liquidity. Conversely, fixed capital requires careful planning in order to make well-informed investment decisions that complement a company’s long-term strategy.

How Working and Fixed Capital Interact in Financial Planning

For financial stability to be maintained, working capital and fixed capital must interact effectively. For instance, an increase in fixed capital may lead to higher manufacturing capacity, which can, in turn, increase working capital requirements due to greater demand for labour and raw materials. On the other hand, a lack of working capital may limit a company’s ability to utilise its fixed assets effectively. This highlights the importance of integrating both forms of capital management. In summary, managing both fixed and working capital effectively is essential for ensuring sustainable growth and maximising operational efficiency.